To date, it appears that policy, regulation, and enforcement have been greater drivers of change than consumer preferences. However, there is evidence that consumers are willing to alter their purchasing behaviour when the cost is low; cars, after all, remain an expensive household purchase. Client pressure, for its part, has so far not significantly changed patterns of demand in the logistics sector.

In 2020, Covid-19 has altered this picture at the margins. “There have been sudden changes in behaviour which would have been impossible to predict,” according to Louis Burns, Partner, Mazars. “At the moment it’s a challenge to know which of these are permanent and which are temporary.”

Consumers want sustainability… if they can afford it

One area where we see cost concerns stalling consumer preferences for more sustainable alternatives is electric vehicles (EV). After all, EVs remain significantly more expensive than other cars in Europe and the US. Nevertheless, customers are slowly moving towards an electric future: in June 2020, 6% of car sales in the UK were EVs, up from 1% a year earlier.

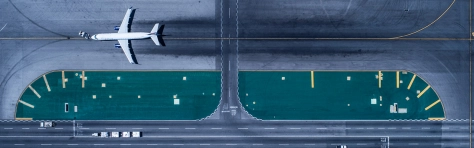

In logistics, on the other hand, there is much less pressure from end-user clients to become more sustainable. Where there is a push to change, it normally comes from activist shareholders or social movements. “In Norway, for example, there is a growing sustainability movement attracting world-wide attention and funding,” says Rachel Lawton, Director, Mazars. The Ocean Opportunity Lab, a hub for entrepreneurs and innovators committed to green shipping, is part of that movement.

Changes in the name of sustainability are likely to happen sooner in Europe than in the US, predicts Richard Karmel, Managing Partner, Mazars, “At a corporate level, we know that the USA is long way behind Europe. In the US, only the biggest brands appear to be taking economic, social and governance (ESG) seriously, which may be because they are themselves more global.”

Karmel does, however, note a generational change, which is even visible within Mazars itself. “Just looking at our graduate and school leaver intake over the years, ESG issues are talked about much more.” This is consistent with wider attitude polling, which shows that younger people are more concerned with sustainability and climate issues. If this translates into a consistent preference for shared vehicles over ownership, it may be a long-term headwind for car ownership.

Although consumer preferences are shifting products and practices in the automotive and logistics sectors, Karmel says that “the minority of consumers who care about ESG issues is probably growing, but they are still a minority.”

Covid-19 may accelerate change

The Covid-19 pandemic may alter these trends: “The outbreak has brought the rise of vehicle sharing to an abrupt halt, as sharing cars simply isn’t possible without an onerous cleaning regime in place,” explains Burns.

“Car rental firms have to demonstrate very robust cleaning procedures between every car hire and be respectful of social distancing requirements on car collection and drop-off. It is too early to say whether this constitutes a long-term brake on the growth of carsharing.”

There are already signs that in light of the pandemic, employees will start to work from home permanently. Given the economic downturn, there is certainly a short-term incentive for companies to encourage it. Burns speculates that this may alter consumers’ calculations on price and convenience between car ownership and rental. “It may lead to an overhaul of people’s views on how many cars they need and how much they need to travel. If the journey to the office is now just two days a week and not five, could that be the tipping point for ‘paying on demand’ services such as taxis or rental cars?”

New carrots, new sticks

Policy interventions are a greater driver of change than consumer preferences, at present.

“Movement around large cities is changing in response to tougher clean air regulations,” says Burns. “Most of them are geared towards removing fossil fuel cars from the roads in city centres. That might mean fewer parking spaces, more pedestrianised spaces, or more or wider bike lanes.”

In the UK, the government has a history of subsidising hybrids. It was unclear to what extent the policy was driving demand until the government removed the subsidy in 2019. Sales stalled. “With the subsidy removed, the incentive to move towards an electric vehicle was reduced,” explains Burns.

He contrasts this situation with Norway, which is far ahead of other countries in its adoption of electric vehicles. “Since the 1990s, the Norwegian government has been consistent in their approach,” he says. “There is a range of cost benefits that EV drivers enjoy, including no road tax, reduced tolls and parking costs, and exemption from the 25% VAT on car sales. The government has also invested in infrastructure to charge EVs. It is easier and cheaper to drive an EV in Norway than the UK, so more people do.”

A similar dynamic is at play in the transport and logistics sector, according to Lawton. "The International Maritime Organization has introduced new regulations that limit the sulphur content of ships’ fuel oil. Ship owners which do not comply are unable to insure their ships or operate them in certain ports and waters. In this sector, legislation and reputation are probably the biggest drivers of change.”

She does point to some innovation, however. “Maersk is looking for ways to make its ships’ engines more efficient and companies such as Shell are also looking at innovation in fuel efficiency and carbon output,” she explains.

It seems that widespread consumer concern about climate and sustainability issues have created a large pool of consumers who would prefer to shift to more sustainable ways to travel, but only if costs fall and convenience grows. “As the costs of batteries and other key EV components fall, consumers are likely to become ever more important for, and interested in, the transition to sustainability,” says Karmel.

[1] https://www.pewresearch.org/global/2019/02/10/climate-change-still-seen-as-the-top-global-threat-but-cyberattacks-a-rising-concern/